Again the focus will be on the ‘balanced budget rule’ (structural deficit < 0.5% of GDP) rather than the ‘debt brake rule’ (reduction of 1/20th in the debt to GDP ratio of the excess over the 60% threshold). The debt brake rule has got a lot of attention but it is the balanced budget rule that will have the biggest impact.

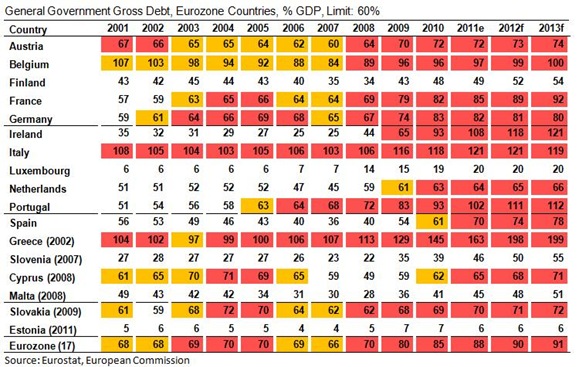

Here are actual and forecast general government debts in the eurozone from 2001 to 2013. Click to enlarge.

Data to 2010 are from Eurostat and forecasts to 2013 are from the European Commission. Yellow indicates that a country is in excess of the 60% of GDP limit and red indicated that the country also fails to meet the numerical debt reduction target of the debt brake rule. From the perspective of the proposed rules this is not a pretty table. A table of the government deficits for each year can be seen here.

Under the proposed rules, when a country gets below the 60% of GDP limit it is allowed to run a structural deficit of 1% of GDP. If we assume that the output gap averages zero over the economic cycle, this means that a country is expected to run average overall deficits of 1% over the cycle. As Prof. Whelan has shown in a situation with 4% nominal GDP growth this means that the general government debt will converge on a level equal to 25% of GDP.

This is well below the 60% of GDP benchmark level but it is important to remember that this 60% benchmark is not a target to be aimed for, but is a level that the debt “does not exceed”, in the words of the Fiscal Stability Treaty.

Thus the 60% of GDP is an upper limit. In order to stay within this limit it would be necessary that countries be below the 60% of GDP level to absorb the debt effects of a downturn and remain below the 60% of GDP limit.

So how far below the 60% of GDP level is required to satisfy this?

We can use some examples from the above table. Consider the case of Spain which in 2007 had a budget surplus of 2% of GDP and a debt of 36% of GDP. On the basis of the original 3% deficit and 60% debt rules Spain was in a very healthy position in the run up to the crisis. Just three years later Spain had breached the 60% threshold and the general government debt ratio is forecast to have more than doubled to 78% of GDP by 2013.

This might suggest that a debt of 36% of GDP does not offer a sufficient buffer to allow a country to stay below the 60% of GDP benchmark in response to a downturn. However, Spain may not be an appropriate example as the relative health in the public finances was not reflected in the overall economy.

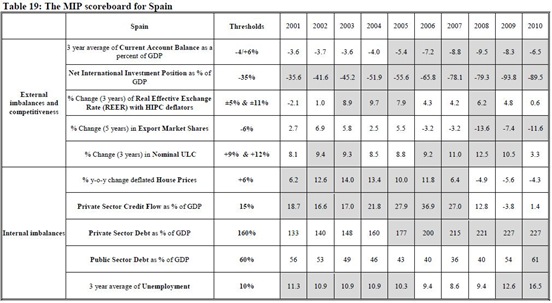

This can be seen if one examines Spain’s Macroeconomic Imbalance Scorecard for the past ten years. This is not an economy that was “in balance”. For example in 2005, Spain exceeded the balance threshold for seven of the ten measures in the scorecard. Click to enlarge.

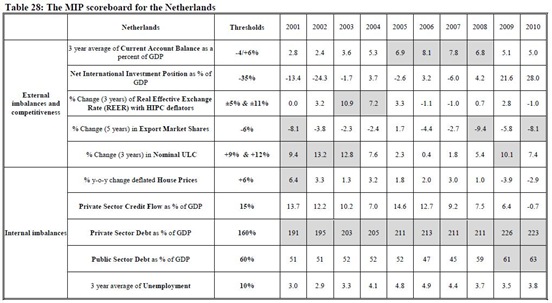

A better example might be the Netherlands which in 2007 ran a small budget surplus of 0.2% of GDP and had a general government debt of 45% of GDP. The Macroeconomic Imbalance Scorecard for Holland shows an economy in reasonable shape. The only significant imbalance is private sector debt and that is mainly a result of the structure of mortgages and pension savings for Dutch households (net debt is much lower than the gross figures given here). Again click to enlarge.

The Netherlands looked to be in a reasonably strong position in 2007 but breached the 3% of GDP limit in 2009 and exceeded the 60% of GDP debt limit in 2009. The debt is expected to stabilise quickly and is forecast to be 66% of GDP in 2013. The point is though, that running budget surpluses and having a debt ratio of 45% of GDP is not enough to keep a country below the 60% of GDP threshold in response to a downturn.

And the downturn in the Netherlands was relatively mild compared to what we have experienced here. Between 2007 and 2009, real GDP fell 1.8%. By 2011 real GDP is expected to be 1.1% up on its 2007 level. In nominal terms GDP was down 0.1% between 2007 and 2009 and up more than 6% from 2007 to 2011. When compared to the Irish performance over the same period this is a mere speed-bump.

The implication drawn by those who devised the fiscal rules is clear. Small budget surpluses and a debt of 45% of GDP are not sufficient buffers to ensure that a country in a relatively good economic position will stay within the 3% of GDP deficit and 60% of GDP debt limits. Bigger surpluses and smaller debt are required.

The proposed budget rules seem designed to force balances to levels that will see public debt levels approach 25% of GDP (assuming 4% nominal GDP growth). In general, this seems a remarkably low level of public debt to target given that countries rarely have to repay debt but can merely service the interest into perpetuity.

[It is perhaps a little ironic that Ireland had a debt ratio of 25% of GDP in 2007 and now has one which ended 2011 at 108% of GDP and is rapidly hurtling towards 120% of GDP. Maybe the target should be lower than 25%.]

It would be useful if economics had empirical evidence to support the 25% of GDP level as an appropriate target, or the 60% of GDP level as an appropriate limit, or (in the case of Greece in particular) the 120% of GDP level as an appropriate danger threshold. No such benchmarks exist. It has been suggested that a government debt above 85% of GDP harms growth but we do not know what is the wrong (or right) level of debt.

The proposed rules in the Fiscal Stability Treaty, and more particularly in the revised Stability and Growth Pact, are designed to bring public finances in the EU to an extreme level of fitness rather than a level that might be considered “normal”.

In particular, it is the structural deficit rule that has the biggest impact. Targeting deficits that are created by political decisions is a useful move, but setting a limit on these of 1% of GDP on these may not be. As Prof. Whelan said in a presentation to the ICTU “there is no need for a balanced budget [ ] as long as GDP is growing”.

Of course, the above is a very mechanical interpretation of how the rules will be applied in practice. When the rules come into force there will be country-specific Medium Term Budgetary Objectives (MTO) that each country will have to target. Although some guidelines have been provided on the formula to be used to create the MTOs we are still awaiting the specifics.

In order to operationalize this formula, explicit parameters will be made public through a Commission services paper, endorsed by the EFC.This may outline how the flexibility built into the rules will be incorporated and whether it is likely that average deficits of more than 1% of GDP and debts of more than 25% of GDP will be allowed. Tweet

No comments:

Post a Comment