While a lot of attention will undoubtedly be on the GDP and GNP figures in the Quarterly National Accounts release from the CSO the real action is probably in the Balance of Payments and this is also where we might find some impact of the €3 billion of extra Corporation Tax that looks set to be collected this year.

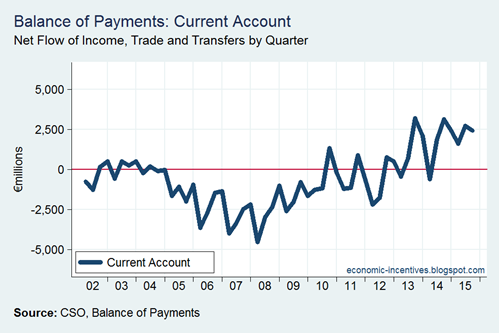

The balance on the current account seems to suggest that things are little different in 2015 to the past couple of years – a sizable current account surplus.

We have run a current account surplus of €6.8 billion so far in 2015 compared to a surplus of €4.4 billion in 2014. Be wary before thinking that this is ours though!

Even though the balance may be little changed if we look at the components of the current account we can that there is a lot going on. The balance of merchandise (visibles) has nearly doubled since the end of 2013 while the balance of services (invisibles) and the balance of income (mainly primary) have moved in the opposite direction.

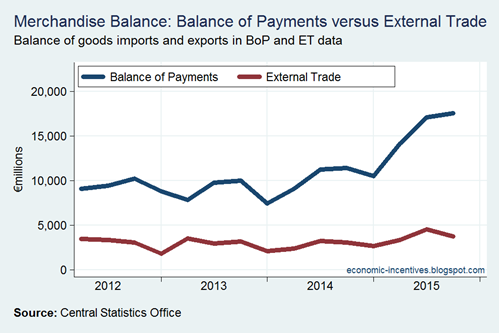

Of course, anyone looking for the surge in the merchandise balance won’t be able to see it in the separate External Trade figures published each month which track visibles that physically leave Ireland. Here are the balances from the External Trade data and the merchandise data in the Balance of Payments since the start of 2012.

The reason for the divergence is down to ‘contract manufacturing’ which results in goods exports appearing in Ireland’s Balance of Payments and National Accounts data even though they are not in the External Trade data.

There are offsetting outbound flows to these exports. In particular, outbound royalty payments which appear under services in the current account of the balance of payments. These payments were running at around €8 billion a quarter up to the end of 2013 but are now averaging around €15 billion a quarter - €60 billion a year!

These increased outbound payments are part of the reason the balance of payments is showing a services trade deficit after briefly moving into surplus in 2013. It has been explained that the growth effect of these flows is not significant as the inbound merchandise flows are offset by outbound royalty flows.

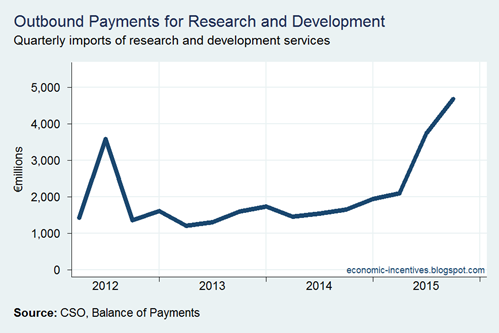

However, outbound royalty payments aren’t the only thing behind the services deficit in the Balance of Payments. Just take a look at R&D imports in 2015.

Ireland’s imports of R&D were already oversized in European terms when they were €5 billion a year – they’re now heading for €5 billion a quarter.

There are a number of things that could be driving these increases. The first are increased payments under R&D cost-sharing agreements to pay for new product and intellectual property development; the second is the outright purchase of patents and intellectual property by Irish-resident companies.

Whatever is going on it really took off in the second and third quarters of 2015. And if these are once-off outright purchases rather than on-going expenditures then they will have an impact as they wash out of the figures.

So we have increased inflows under merchandise and increased outflows under royalty and R&D services but in aggregate terms one is not enough to offset the other.

In the first three quarters of 2013 and 2014 the net balance of merchandise and services combined was around +€27 billion; for the first three quarters of 2015 the balance is +€34 billion. Someone is selling more than they are buying.

Maybe we can see this if we look at the profits earned by FDI in Ireland.

There is an upswing in 2015 but not hugely so. For the first three quarters of 2014 the profits of direct equity investment in Ireland were €28 billion. In the first three quarters of 2015 they were just short of €33 billion.

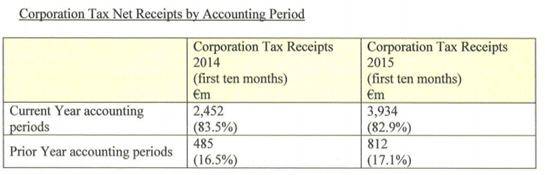

An increase, yes, but not one that explains an extra €3 billion of Corporation Tax. In his recent letter to the Minister for Finance outlining the sources of the extra €2.2 billion received to the end of October, the chairman of the Revenue Commissioners showed that most of the increased Corporation Tax relates to the 2015 accounting period. This table is taken from the letter.

It shows that Corporation Tax receipts for the current accounting period in 2015 were €3.9 billion compared to €2.5 billion for the equivalent current accounting period in 2014. An extra €1.4 billion of Corporation Tax could be expected to correspond to around €12 billion of extra profits. The balance of payments data show less than €5 billion of extra profits on FDI so we’re not even have way there.

Niall Cody also said that €300 million of the surplus Corporation Tax receipts were a one off so that is probably related to capital gains rather than trading profits so that gets us a another bit of the way there. Of course, Irish companies may also be making higher profits so maybe we not as far off explaining the higher Corporation Tax receipts as the Balance of Payments figures might suggest.

Tweet

No comments:

Post a Comment