The release of the Q4 2016 mortgage arrears statistics generated more interest than has usually been the case for these releases for the past two years or so. Two elements have featured heavily in the reporting:

- That the highest number of PDHs on record were taken into possession by lenders

- That there was an increase in “early stage arrears”.

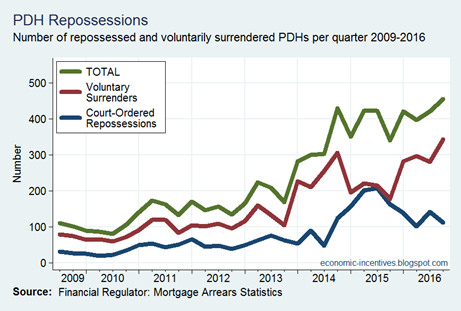

The first of these is fairly easy to identify. At 455, the total number of PDHs taken into possession in Q4 was indeed the highest on record.

Of these, 112 were the result of a court-ordered repossession while 343 were by agreement between the borrower and lender. The term ‘voluntary surrender’ is a benign way of putting as the borrower will likely have faced strong pressure from the lender. Voluntary surrenders are likely in instances where there is negative equity with hopefully agreement also reached on how to deal with any shortfall.

There will also be instances where the borrowers undertake a forced sale of the property to clear the mortgage. In these cases the borrowers also lose possession of the property but have some limited control over the process. Figures for forced sales have never been collected.

The status of the properties taken into possession by the lenders is unknown but a share will be vacant or abandoned properties which should be taken into possession and resold by lenders.

There is also a divergent pattern since the middle of 2015 when there was a 50/50 split between court-ordered repossessions and voluntary surrenders. Since then the number of court-order repossession has declined with the number of voluntary surrenders going in the opposite direction.

Since this data series began in the middle of 2009, lenders have take possession of 7,100 PDHs. Of these 4,800 were by way of a voluntary surrenders and 2,300 the result of a court ordered repossession. This is a small number relative to the scale of the arrears problem.

And it is suggested that part of the arrears problem could be getting worse. Many reports are the same and this is extracted from one:

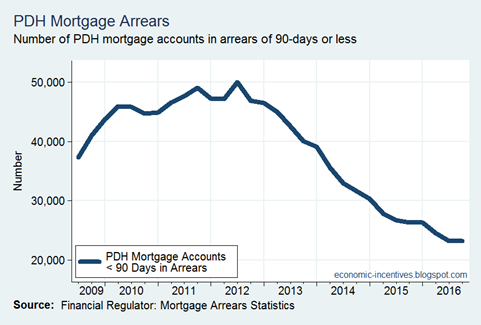

The latest arrears figures show that 23,224 mortgage accounts were in arrears for less than three months at the end of last year. This was up slightly on the previous quarter in 2016.

However, it was the first time since September [2012] there had been a rise in the numbers getting into early-stage arrears.

The editors obviously felt this was an important point and used the headline “Spike in mortgage arrears as banks repossess more homes” for the piece. Here is the Q4 spike:

Hmmm. There is no spike visible in the chart. There isn’t even an increase visible. The spike is an increase of 12. Total. In Q3, there were 23,212 PDH mortgage accounts in arrears of 90 days or less; in Q4 the figure was 23,224. Yes, a rise of 12.

Experts said it was too early to say if there was a trend of arrears rising again.

They could also do with saying that the number of people in 90-days arrears doesn’t necessarily tells us anything about the number of people falling into “early-stage arrears” particular when the overall trend in arrears is down.

Arrears measures missed or partial payments relative to the contracted payment amount. It tells us nothing about when those payments were missed. If a borrower has a monthly payment of €1,000 and missed €2,000 worth of payments three years ago they will be 60 days in arrears – yet can have made all contracted payments in three years.

If such a borrower has €4,000 of arrears they will be 120 days in arrears. If that borrower makes an excess payment of €2,000 they will move to being 60 days in arrears. And this is why the number of accounts in 90-days in arrears is not necessarily a good guide to the number in “early-stage arrears”. It can also be influenced by people moving from higher categories into lower ones.

And it can happen for odd reasons. Consider a borrower on an agreed interest-only of €750 with €3,000 of arrears. The borrower is 120 days in arrears. If the interest-only period ends and the borrower moves to a capital+interest payment of €1,500 (which we assume they make) the borrower will now be 60 days in arrears. The borrower has moved into the lower arrears category because their contracted payment has increased but the amount of arrears has remained unchanged. Such a scenario is highly unlikely but points to some of quirks that the use of arrears as a measure of distress can result in.

Was there a rise in early-stage arrears at the end of 2016? We can’t say but I doubt it. It more likely reflects an improvement in the situation (i.e. lower arrears or restructures moving people into lower categories) than a deterioration.

Tweet

No comments:

Post a Comment